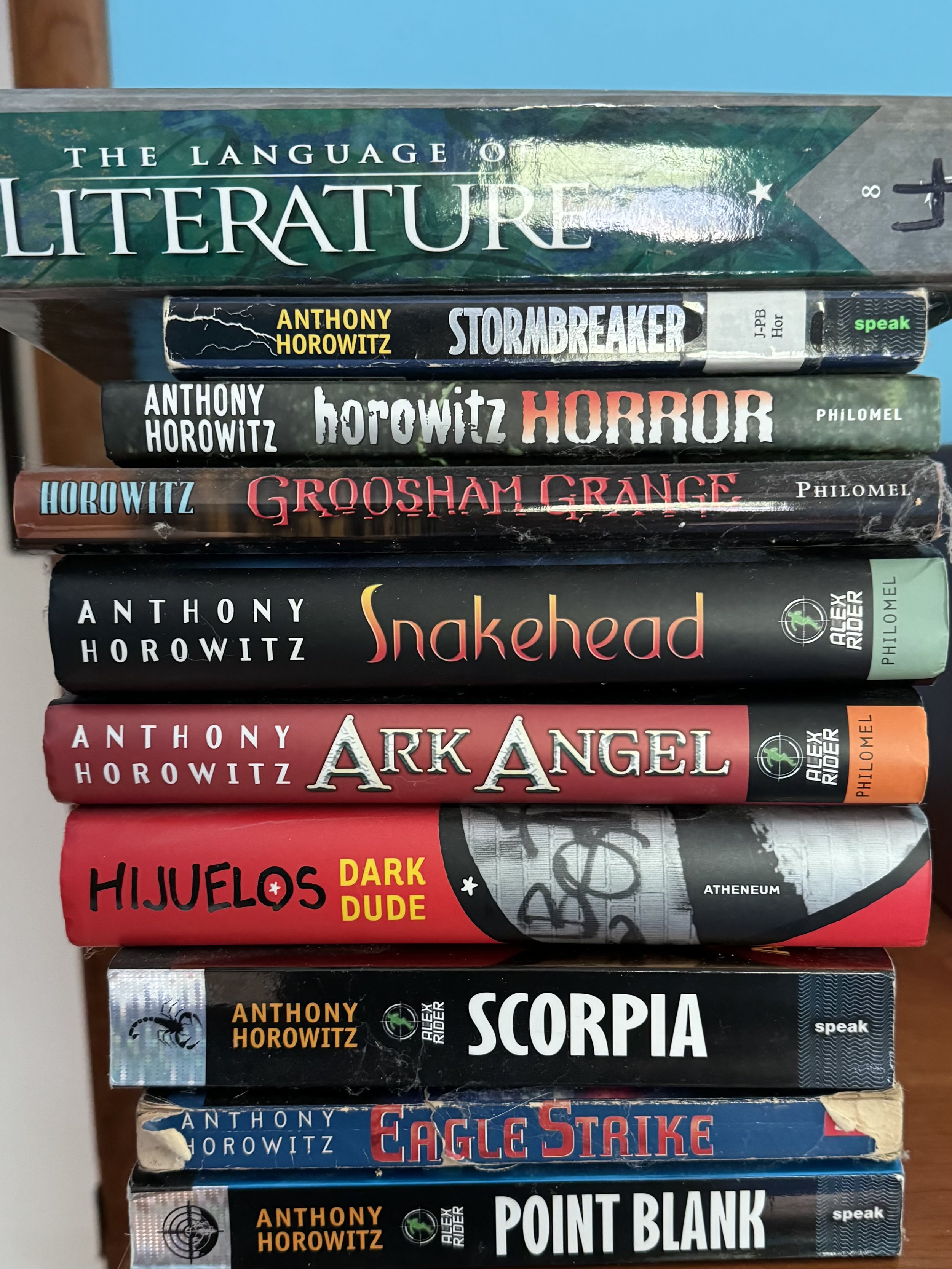

A first attempt at sourdough rye. Verdict? Edible.

In the course of a life, one is constantly presented with the opportunity to learn things. Sometimes one is required to learn them for school or for work and sometimes we are drawn to them because of interest or passion. We often ignore the optional opportunities because of time constraints or laziness. But sometimes we take up a learning opportunity and pursue it until we reach a level of competence. For those with talent (or more likely extreme perseverance), a level of mastery may be achieved. Though far from mastery level, these are four useful skills I have acquired and which I continue to try and improve after decades of application. I offer these not as a boast nor to suggest that you pursue these but rather for you to consider what skills you are practicing and be alert to what you might want to take up next.

I am not including in this list the skills that are essential and that virtually everyone learns. These are so universal as to be taken for granted. (obviously, I understand that they cannot nor should not be taken for granted.) These include, reading, writing, basic math, driving, dressing oneself, etc. I am speaking of optional skills that while anyone might learn them not everyone does. Everyone, I suspect has a list that is unique to them. Here are mine.

Accounting/Double Entry Bookkeeping

Easily the most useful skill I learned for my work life and for understanding and managing my personal finances. As an English major, I assiduously avoided classes that involved business or math. But when I found myself in my first nonprofit job there was a vacuum in the finance function of the organization. I made a deal with the executive director that if she would buy me a Macintosh to work on, I’d get the organization’s books squared away. To be clear, my motivation was getting a Mac to use at work (I already had one at home) not to learn double-entry accounting.

I didn’t know the first thing about accounting. With the help of a college textbook, the organization’s external auditor who was generous with his time, and a lot of trial and error, I taught myself accounting. It opened incredible pathways and opportunities in the course of my career. I used the same professional level accounting software that I used at work to manage my personal finances as well and thus gained a level of understanding that allowed me to make better decisions about investing and our household finances. To this day, I track all our household income and spending to the penny as if it were a small business, which it pretty much is. This level of control is not for everyone, but I can’t imagine not doing it after all these years.

More importantly, I have come to appreciate double-entry accounting as one of the most beautiful and perfect systems devised by human beings. It is also the closest thing we have to a near universal system adopted around the world (but for the U.S. the Metric System could be that). Virtually, every business in the world that has an accounting system double-entry bookkeeping.

Bread Baking

Ever since that first loaf, I baked to write about for Freshman English in 1980, I have been an avid baker. I conservatively estimate that I have made more than 2,500 loaves of challah, hundreds of bagels, and countless loaves of wheat, rye, and kamut, breads. Last week, I obtained a portion of sourdough starter from my dad, I have begun a sourdough journey with four loaves having already come to fruition. Two of them were good and two had disappointing oven spring. They were still quite edible notwithstanding. Aside from the few who eschew gluten for health or theological reasons, people love bread. Friends and family are always delighted to receive a loaf of bread. It is an easy way to make people happy and the process of turning flour, water, and salt into bread is rather magical. In most cases any bread you bake at home will be better than anything you can buy at a grocery store. Far less expensive as well. It is a rare week that I don’t bake at least one loaf.

Knife Sharpening

I love to cook and nothing makes cooking more enjoyable than a good sharp knife. It is hands down the most important tool in the kitchen. If your knife is sharp, you work faster and more effortlessly. You will cry less over your onions. A sharp knife is safer to use since it is less likely to slip.

The best way to sharpen knives is with a set of whetstones but finding the process somewhat intimidating, I avoided them for years. I tried every other sort of sharpening system including manual handheld sharpeners, electric sharpeners and a system where the blade was held in a fixed position and the sharpening stone was pushed against the blade. None of these systems proved satisfactory. I wanted a blade so sharp I could shave my arm hair with it.

Around 10 years ago, I broke down and bought my first set of Japanese whetstones. I watched countless YouTube videos on sharpening, and I made many a knife worse before I started making them better. But after a few hours over many months, I got the hang of it. Now I sharpen my knives every six months or so and in between I hone them on a ceramic hone that brings them back to razor sharpness with a few strokes. My favorite knife is a fussy santoku with a carbon steel blade that will rust if not washed and dried immediately after use. But it is fast to sharpen, holds and edge, and is perfect for my hand. Let me tell you it glides through food. Keep your fingers away from the blade! Why, it’s sharp enough to shave the hair from your arm! But don’t. Safety first!

American Sign Language

We found out our daughter was deaf when she was 10 months old. A week later, we left on a family vacation, a road trip to Montreal, with a brand-new copy of The Joy of Signing open in the front seat. That week my wife, my daughter and I learned our first signs and a few weeks later my daughter made her first sign. It was a request: “Milk.”

If the only thing learning sign language allowed me to do was to communicate with my kids, dayenu. It would have been enough. But it did so much more. Learning ASL opened me to a world that a scarcely knew existed. The Deaf world is a vibrant and robust subculture. It also led me to an involvement in Jewish life that I had previously been a stranger to. (That is a story for another day.)

Some of my most fulfilling experiences were the twelve Birthright Israel trips where I staffed the ASL trip. The Deaf students and Israelis that I had the opportunity to get to know over those 10-12 day trips changed the way I see the world. I was on one such trip when Apple announced that its new system software would allow iPhone users to make video calls “FaceTime” allowing Deaf people to have synchronous conversations over the phone as hearing people had had for more than 100 years. I don’t know that I have ever seen anyone so excited about a new technology as those students were.

My ASL skills have stalled in recent years. With my kids far away and no opportunity to sign every day, my level of competency, always more conversant than fluent, has stagnated somewhat. Still, I can mostly keep up my end if my conversation partner is patient and slows down for me. It is the closest I come to a second language.

Check out the new Deaf President Now! movie on Apple TV+ to see how Deaf people took control of their destiny at Gallaudet University the year before my daughter was born.

Each of these skills took between 10 and 20 years to attain a level of competency. In none of them am I even close to among the best. In fact, the most I would claim to be at any of these is adequate. Still I am always on the lookout for the next learning opportunity that might present itself. I might just have enough time to get pretty good at one more thing.

The world’s a narrow bridge; fear nothing.