Back to the Future: My Seiko Field Watch with Mechanical Movement. No batteries, no charging. Seiko is one of the only brands that uses a different color not only for Sunday (red) but also Saturday (blue). Shabbat Shalom! Fun Fact: Many Japanese calendars also show Saturday in blue.

Disclosure: I am not just an Apple Fanboy, I am also an Apple Shareholder.

As you may recall, last week I wrote about my decision to try a week without wearing an Apple Watch having worn one every day since my Apple Watch Series 0 arrived at my door in 2015.

I wanted to enjoy once again the pleasure and simplicity of wearing a watch that just told time. I wanted to see what it was like to not be constantly nagged or prodded to stand up or to fill my “rings” and to not be “tapped” on the wrist every time I had a message or a notification that my watch thought I needed to see.

To ensure that there was no possibility for back sliding, I unpaired my Apple Watch Ultra 2 from my phone and set it up for my wife instead.

Well, I made it through the week and here’s what I missed and didn’t miss about my Apple Watch.

First of all, there was some habitual things to get past. I was used to being able to raise my wrist and say things like, “Set a timer for 30 minutes.” or “Turn off the dining room lights.” Now I had to reach for my phone to do those. Sometimes I had to find my phone. With the Apple Watch you can just ping your phone and have it make a noise. Now, finding my phone meant walking from room to room looking for it.

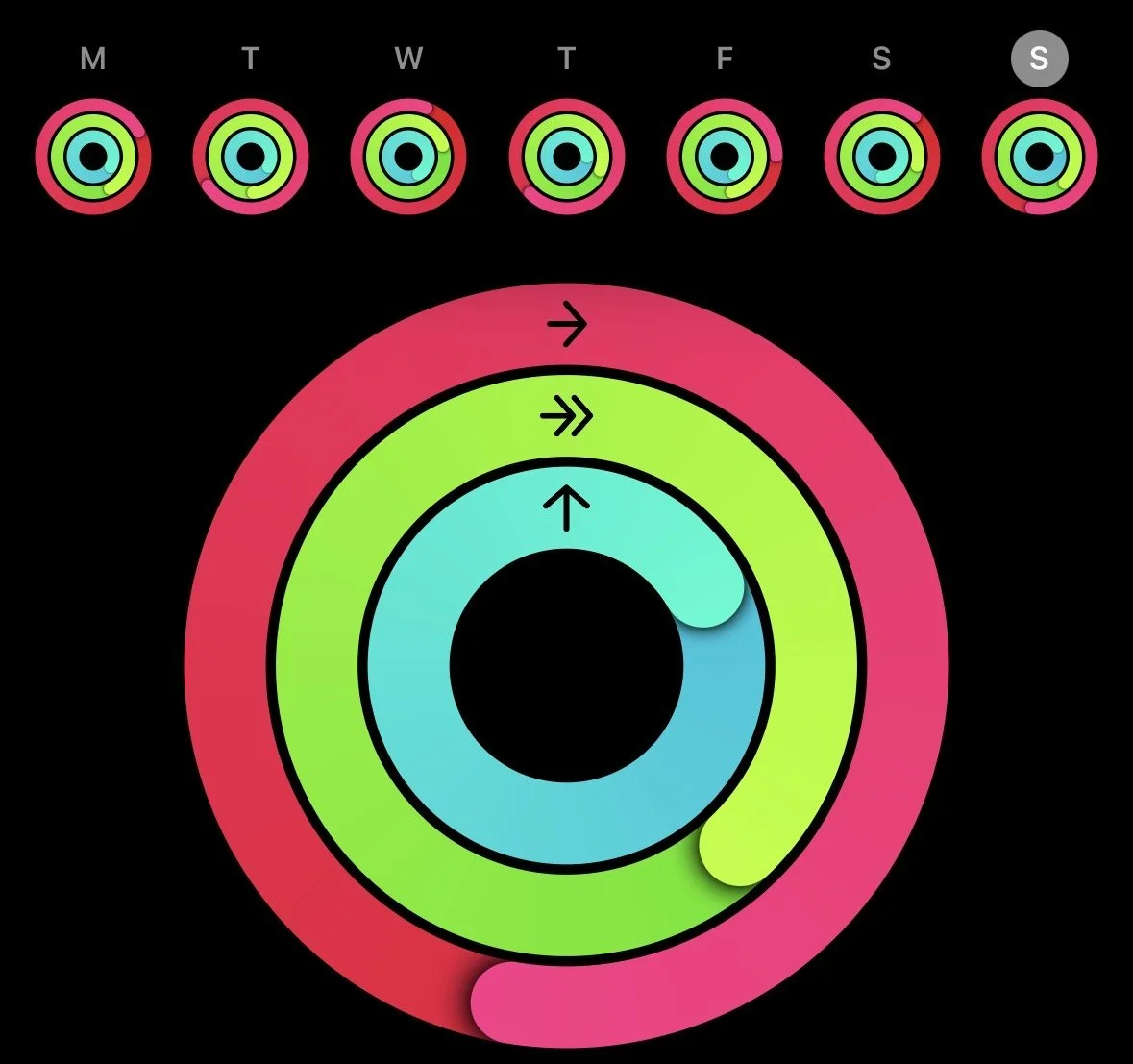

Next were those move, exercise and stand rings. I did find that without them I was a bit less motivated to go for my run or my walk. I still did them anyway but it was a little more of an effort to get out the door. For my run, I worn an old Casio G-Shock that tracked the time but not the distance, pace, heart rate zone, etc. My phone could track the distance but I found I missed the more detailed data.

Finally, there was the sleep tracking. This I found I didn’t miss at all. It was a relief to not get up in the morning and have my watch tell me how well (or badly) I’d slept. Nowadays, I rarely have to be up at a certain time so I sleep as long as I do and I get up when I wake, normally between 6 and 7. I didn’t mind less information about my REM versus deep sleep. However, I did miss being able to check the time when I woke during the night. That however, could be easily fixed with a bedside clock.

This was my grandpa’s quartz watch. Last time I put a battery in it, it still worked but the date doesn’t advance. It’s always Friday.

Back in the day before Apple Watch, I wore a watch only when I was outside the house. When I arrived home I took it off. Since then, I have become used to feeling a watch on my wrist all the time. So I wore my analog watch most of the time and enjoyed that. It was nice to look down to check the time and see my clean field watch face with its cheery red tipped seconds hand making its way around the dial. From time to time I’d take if off and watch the balance wheel oscillating through the exhibition case back. Or I’d press it to my ear and listen to the watch tick.

A mechanical watch is a marvel of art and engineering with a rich history that goes back hundreds of years. People still love them even though a cheap quartz watch or the phone you already have does the job more accurately.

My Seiko Field Mechanical gains about 5 seconds a day. By the end of the week, it is more than half a minute fast. It’s not a big deal. On Sunday, I adjust it back to the time on my phone. And I’d rather it run a little fast than slow. (Fun fact, the Apple Watch has a feature that allows you to set it “fast” and display a time that is a head of the actual time for people who are worried about ever being late.)

In the end, I went a bit over a week. I took off my Apple Watch on Friday before Shabbat and on Saturday night I retrieved my wife’s 5 year old Apple Watch Series 6 and paired it to my phone. I decided that Barbara, who is much more the serious athlete, should have the better watch with the bigger battery and more advanced workout features.

When I went for my Sunday run, I wore her old Apple Watch and it worked just fine for me. That day, I wore it (on my right wrist) until I filled my fitness rings and then took it off. I continue to wear my mechanical watch on my left wrist all the time.

Bedtime use has been sporadic. I turned off the notifications about my sleep quality but I have worn it to bed sometimes because I like to be able to check the time when I wake up during the night. For whatever reason, wearing my mechanical watch to bed feels strange.

My first Apple Watch Series 0, May 2015

So here is where I think I’ve landed.

The Apple Watch is the best workout tracker I have ever used. I will continue to use it for runs, walking, and biking.

However, I am not going to wear it all the time and worry less about whether I fill each ring every day.

My analog watch will be my primary time keeper on my left wrist. Except when exercising my Apple Watch will stay at home or perhaps tucked under my right sleeve as a quiet fitness tracker. The Series 6 is better as a hidden fitness tracker since it is smaller and lighter than the Ultra 2.

Having said that, for people who don’t care about wearing wearing a traditional watch or don’t feel they need their tech to be less intrusive, an Apple Watch is a great tool. It can motivate you to exercise more. It’s handy to pay for stuff with Apple Pay. And it’s got little helpers like timers, weather, reminders that make daily life more convenient. Just as an iPhone is really more of a pocket computer than a phone, an Apple Watch is more wrist computer than watch. If having a computer on your wrist appeals to you, the Apple Watch is the one to get.

My other grandpa’s novelty watch. Transparent, Deco, still keeps great time.

Another way the Apple Watch is clearly better — it is dead simple to change the band. Apple makes dozens of styles and colors and with 3rd party options the choices go into the hundreds. Meaning what the Apple Watch lacks in personality it makes up for with band variety. I sometimes changed mine two or three times a day depending on my activity. With other watches changing bands can be more of a project.

And, no doubt, the Apple Watch has saved lives.

At its introduction, Tim Cook called the Apple Watch “our most personal device yet” because, he noted, you wear it on your body. I suppose that’s true but I do worry about the next iteration of personal devices that instead of being worn are implanted in our skulls.

I am going to go on record here and say I am never getting one of those no matter how smart it can make me seem. I am satisfied with my analog brain even when it has me wandering from room to room looking for lost items.

The world’s a narrow bridge; fear nothing.